Achieving a Just Transition:

Framework for Company Action

Moving to clean energy in ways that decrease inequality

Swift action is required to address climate change and transition to a net-zero economy, yet transitioning to clean energy risks growing inequality with a loss of jobs and investment in impacted communities. Companies have a key role to play in contributing to this urgent global shift, and it is imperative to do so in a way that is focused on workers, communities, and consumers.

We recognize that we are at the beginning of this journey in transitioning from a fossil-fueled economy to a system of net-zero emissions. There’s a lot to learn from first movers. That’s why the Council, along with bp and BCG, have brought together seven international, energy-intensive companies and investors with academic, civil, and social representatives to develop a hub of resources – best practices, case studies, and research – to support company action.

Together, we have developed a framework for a just transition to provide concrete guidance that companies of all industries can use to lead a swift energy transition that benefits all involved.

Explore the Framework

What’s your best idea for a just transition? Share your actions and join our community >>

What's inside:

Guiding Principles for a Just Transition

Sustainable future for all

Commitment to universal carbon neutral energy access for consumers

Fair and decent work

Creation of more decent jobs alongside adequate and sustainable social protection and right to bargain

Worker rights and social dialogue

Respect of fundamental rights at work and promotion of two-way dialogue

Community-specific approach

No ‘one size fits all’ solutions. Initiatives should be designed for the specific conditions and needs of communities

Social consensus and due participation

Strong social consensus on the goals and pathways to sustainability and an enabling environment for all stakeholders to drive the transition

Diversity and inclusion

Programs take into account the strong gender, racial and socioeconomic dimensions of many environmental challenges and opportunities

Collaboration and transparency

Collaboration between businesses/sectors and evidence-based progress reporting to promote transparency

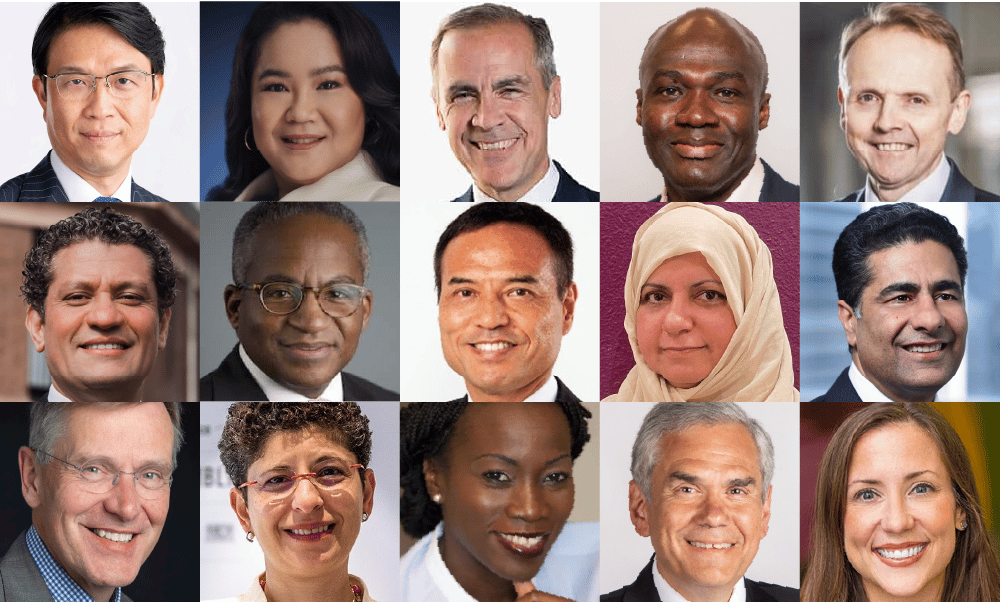

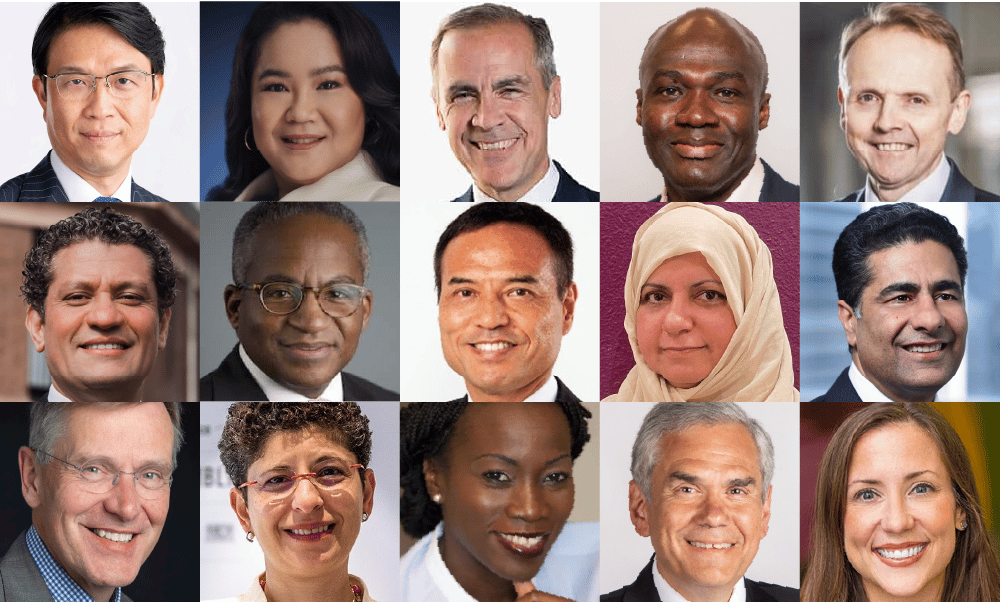

Participating organizations

The Framework for a Just Energy Transition was formulated as part of a collaborative initiative led by the Council for Inclusive Capitalism, bp, and Boston Consulting Group (BCG), with the involvement of the UN Special Envoy for Climate Action and Finance, the International Trade Union Confederation, State Street, CalPERS, and Inclusive Capital Partners.

Join the movement for a just transition

It will take the collective actions of us all to achieve a just transition. Share your own commitments to action by becoming a member of the Council’s community of hundreds of companies creating jobs, protecting natural resources, reducing inequality, and improving the quality of life for those affected by climate change. Click above to learn more about membership and sign up your organization.

JOIN THE COUNCIL

Recognizing it will take alignment of all our organizations to scale impact globally, we invite you to join the movement as a Steward or Ally of inclusive capitalism. Together, the collective action of Council members will contribute to a fairer, more inclusive and sustainable future for all people and our planet.

The Council for Inclusive Capitalism does not provide investment advisory services or products. Any statements located on our Site should not be construed as or relied upon as investment advice. Please see our Terms of Use for more information.