State Street Corporation is an American financial services and bank holding company headquartered at One Lincoln Street in Boston with operations worldwide. It is the second-oldest continually operating United States bank; its predecessor, Union Bank, was founded in 1792. State Street is ranked 15th on the list of largest banks in the United States by assets. It is one of the largest asset management companies in the world with US$2.511 trillion under management and US$31.62 trillion under custody and administration. It is the second largest custodian bank in the world.

The company is ranked 247th on the Fortune 500 as of 2019. The company is on the list of the banks that are too big to fail published by the Financial Stability Board.

The company is named after State Street in Boston, which was known as the "Great Street to the Sea" in the 18th century as Boston became a flourishing maritime capital. The company's logo includes a clipper to reflect the maritime industry in Boston during this time.

Ronald O’Hanley

We believe it is vital to state clearly to the world the set of our beliefs about Inclusive Capitalism. As such, we start with our Statement of Guiding Principles for Inclusive Capitalism. Knowing that words alone are not enough, each of us is making a series of commitments about how we will operate our institutions so that they help achieve Inclusive Capitalism. These commitments are forward-looking statements based on current goals, expectations and assumptions, which are not guarantees of future performance. For more information, please refer to our Terms of Use

Filter by commitments

View all

Summary

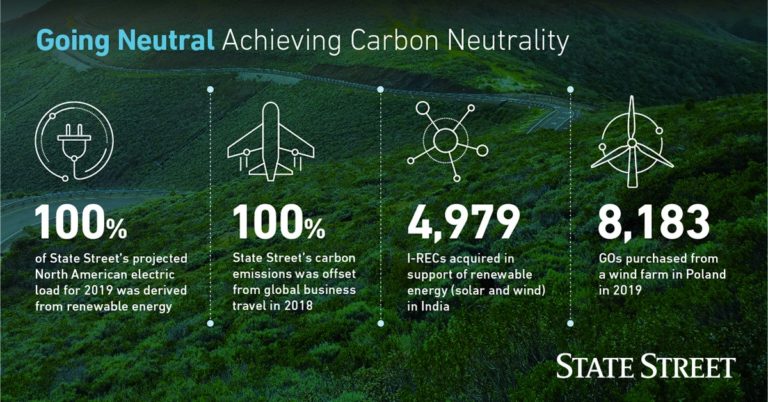

State Street will work to impact climate change by achieving a 27.5% reduction in carbon emissions by 2030 with a 2019 baseline.

Activities & Initiatives

State Street will collaborate with key stakeholders and leverage technology innovations, including implementing appropriate energey efficiency initiatives and reducing energy impacts in real estate portfolio where possible.

Measures & Targets

State Street Corporation will measure progress by tracking the percent reduction in Scope 1 and 2 CO2 emissions with a goal of reaching 27.5%.

Summary

State Street will promote fresh water availability by reducing water usage by 25% by 2030.

Activities & Initiatives

State Street will measure progress by tracking water use with a goal of reducing water usage by 25% by 2030.

Measures & Targets

State Street will measure progress by tracking water use with a goal of reducing water usage by 25% by 2030.

Summary

State Street will sharpen our focus on Black and Latinx talent development by examining all of State Street’s development and advancement programs and processes to improve the mobility and development of Black and Latinx professionals.

Activities & Initiatives

State Street will sharpen our focus on Black and Latinx talent development by examining all of State Street’s development and advancement programs and processes to improve the mobility and development of Black and Latinx professionals.

Measures & Targets

State Street will sharpen our focus on Black and Latinx talent development by examining all of State Street’s development and advancement programs and processes to improve the mobility and development of Black and Latinx professionals.

Summary

State Street will promote diversity and inclusion by conducting anti-racism conversations and trainings, offering an unconscious bias training to all employees by 2025.

Activities & Initiatives

State Street will measure progress by confirming that unconscious bias training has been offered to all employees.

Measures & Targets

State Street will measure progress by confirming that unconscious bias training has been offered to all employees.

Summary

State Street will promote diversity and inclusion by implementing DEI practices for management committees.

Activities & Initiatives

State Street will measure progress by confirming when we have reviewed all governance models within key management committees.

Measures & Targets

State Street will measure progress by confirming when we have reviewed all governance models within key management committees.

Summary

State Street will promote diversity and inclusion by increasing our spend with diverse suppliers over the next three years. We will hold ourselves accountable for strengthening Black- and Latinx-owned businesses.

Activities & Initiatives

State Street will measure progress by tracking our spend with diverse suppliers with a goal of increasing our spend.

Measures & Targets

State Street will measure progress by tracking our spend with diverse suppliers with a goal of increasing our spend.

Summary

State Street will promote diversity and inclusion by leveraging best practices on combatting racism and attracting, motivating, and retaining Black and Latinx people into our profession.

Activities & Initiatives

State Street will partner with State Street Global Advisors’ Asset Stewardship and determine what State Street can learn from others to develop best practices and evolve to a best-in-class organization in combatting racism and attracting, motivating, and retaining Black and Latinx talent.

Measures & Targets

State Street will measure progress by tracking completion of our plan to lead an effort with the asset management industry to attract and advance more Black and Latinx people into our profession.

Summary

State Street will promote diversity and inclusion by establishing combatting racism as a priority for State Street Foundation

Activities & Initiatives

State Street will measure progress by confirming the addition of combatting racism to State Street Foundation priorities

Measures & Targets

State Street will measure progress by confirming the addition of combatting racism to State Street Foundation priorities

Summary

State Street will increase civic engagement and reflection by leveraging Juneteenth as a day of reflection to create awareness and establish a State Street-wide day of service focused on better understanding racism and giving back to our communities.

Activities & Initiatives

State Street will measure progress by tracking the establishment of Juneteenth as a day of reflection.

Measures & Targets

State Street will measure progress by tracking the establishment of Juneteenth as a day of reflection.

Summary

In 2022, distribute $27M to non-profit organizations around the world, primarily in support of funding priorities of education, workforce development, and racial equity.

Activities & Initiatives

State Street will measure progress by tracking the amount of money distributed by State Street Foundation with a goal of $27M.

Measures & Targets

State Street will measure progress by tracking the amount of money distributed by State Street Foundation with a goal of $27M.

Summary

State Street will promote diversity and inclusion by increasing the number of employees of color in VP roles to 33% by 2022.

Activities & Initiatives

State Street will promote diversity and inclusion by increasing the number of employees of color in VP roles to 33% by 2022.

Measures & Targets

State Street will promote diversity and inclusion by tracking the number of employees of color in VP roles with a goal of 33% by 2022.

Summary

State Street will promote responsible consumption and production by increasing our waste recycling rate to 80% by 2025.

Activities & Initiatives

State Street will measure progress by tracking our waste recycling rate with a goal of 80% waste recycled.

Measures & Targets

State Street will measure progress by tracking our waste recycling rate with a goal of 80% waste recycled.

Summary

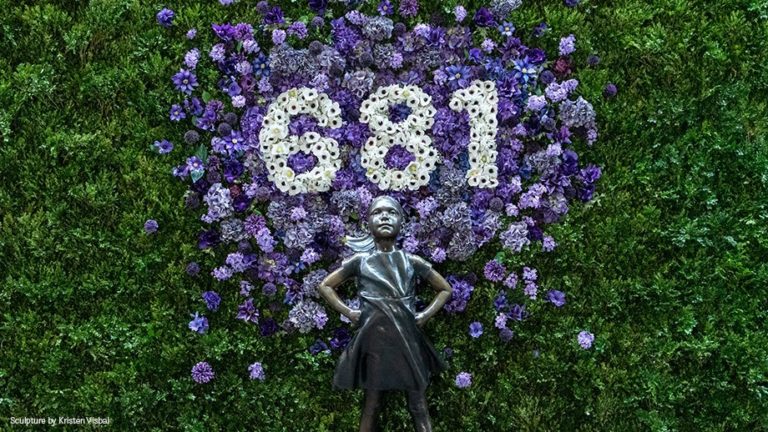

State Street will promote diversity and inclusion by increasing the number of women in SVP+ roles to 36% by 2022.

Activities & Initiatives

State Street will promote diversity and inclusion by tracking the number of women in SVP+ roles with a goal of 36% by 2022.

Measures & Targets

State Street will promote diversity and inclusion by tracking the number of women in SVP+ roles with a goal of 36% by 2022.

Summary

State Street will promote diversity and inclusion by increasing the number of women in VP roles to 38% by 2022.

Activities & Initiatives

State Street will promote diversity and inclusion by tracking the number of women in VP roles with a goal of 38% by 2022.

Measures & Targets

State Street will promote diversity and inclusion by tracking the number of women in VP roles with a goal of 38% by 2022.

Summary

State Street will promote diversity and inclusion by increasing the number of women in AVP roles to 44% by 2022.

Activities & Initiatives

State Street will promote diversity and inclusion by increasing the number of women in AVP roles to 44% by 2022.

Measures & Targets

State Street will promote diversity and inclusion by tracking the number of women in AVP roles with a goal of 44% by 2022.

Summary

State Street will promote diversity and inclusion by increasing the number of employees of color in SVP+ roles to 22% by 2022.

Activities & Initiatives

State Street will promote diversity and inclusion by increasing the number of employees of color in SVP+ roles to 22% by 2022.

Measures & Targets

State Street will promote diversity and inclusion by tracking the number of employees of color in SVP+ roles with a goal of 22% by 2022.

Summary

State Street will maintain carbon neutrality for 2022.

Activities & Initiatives

State Street will collaborate with key stakeholders and leverage technology innovations, including implementing appropriate energey efficiency initiatives and reducing energy impacts in real estate portfolio where possible.

Measures & Targets

State Street Corporation will measure progress by maintaining carbon neutrality in 2022.

Summary

State Street will promote diversity and inclusion by increasing the number of employees of color in MD roles to 22% by 2022.

Activities & Initiatives

State Street will promote diversity and inclusion by increasing the number of employees of color in MD roles to 22% by 2022.

Measures & Targets

State Street will promote diversity and inclusion by tracking the number of employees of color in MD roles with a goal of 22% by 2022.

Sign up your company

Recognizing it will take alignment of all our organizations to scale impact globally, we invite you to join the movement as a Steward of Inclusive Capitalism. Together, the collective action of Council members will contribute to a fairer, more inclusive and sustainable future for all people and our planet.