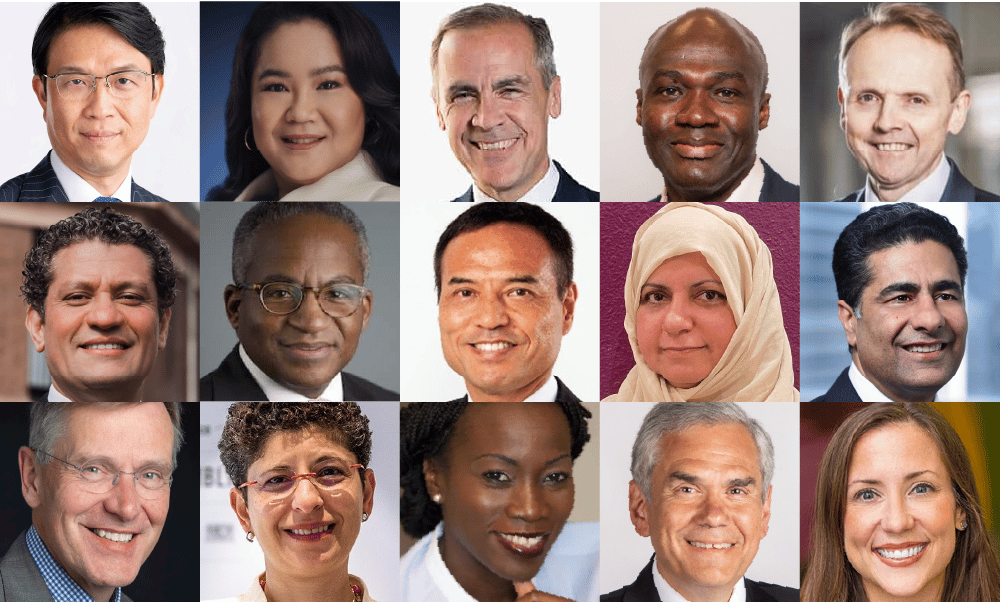

Social Economy Ventures operates with the foundation that diverse/gender-diverse management teams objectively outperform their non-diverse counterparts and competitors at the bottom-line. Our goal is to deploy $25M into these companies by 2027.

Social Economy Ventures' thesis is focused on the evidenced-based concept of ‘The Diversity Premium’ which refers to the tangible benefits that diverse teams bring to companies in various sectors and how it directly correlates to enhanced financial performance and profitability.

By enabling portfolio companies, we aim to influence the cascading economic opportunities that high-growth businesses can impart to the local and regional communities they preside in. We see a unique and timely opportunity to generate superior investment returns, evolve enterprise valuations and strive to influence social change by having those mandates work in parallel. The societal advantage of growing these companies is to benefit the socio-economic outlook and financial behavioral responsibilities of the individuals and families those businesses impact. We see the economic reimagining of the innovation/entrepreneurship model for historically marginalized, diverse entrepreneurs seeking to take their companies from early traction to rapid scale.

Capital & Proactive Counsel: We will support our companies by investing with the mentality that truly great, scalable companies don’t need venture to exist - but rather use investment capital to grow efficiently and adaptively - keeping our eye on real bottom line value creation in order to maximize our opportunity for investor return at every step. Our unique team advantage is having a proven track record of investing and advising complex high-growth organizations and underrepresented entrepreneurial teams. The importance (and sensitivities) of culturally-relevant relationship building is THE perennial objective as a capital solutions provider - and thus establishing the critical credential of “trust” within the investor / portfolio company dynamic. To achieve this “value” with underrepresented teams, is to enable the most effective counsel as a capital source - to achieve rapid scale and ultimate ROI of our portfolio companies.

The key measurements for a venture fund focused on the diversity premium typically revolve around evaluating diversity, equity, and inclusion (DEI) within the fund's portfolio companies and operations. Some key measurements and target values for Social Economy Ventures ("Social") may include:

1. Diversity in Investment Portfolio: Measuring the diversity of the founders and leadership teams of the companies in Social's portfolio. Target values could include a certain percentage of investments in companies led by underrepresented founders.

2. Inclusive Company Cultures: Assessing the inclusivity of the company cultures within the portfolio. This could involve measuring employee satisfaction, retention rates, and diversity in hiring practices. The target values might aim for a supportive and inclusive work environment for all employees.

3. Impact Metrics: Tracking the social impact and positive change created by Social's investments. This could include metrics related to job creation, community engagement, and contributions to underserved markets.

4. Financial Performance: Measuring the financial performance of the fund while considering the impact of diversity and inclusion efforts. While the primary goal is to drive returns for investors, the fund may also target values such as competitive financial performance alongside social impact.

5. Pipeline Diversity: Evaluate the diversity of the deal flow and pipeline of potential investments. Target values may focus on increasing the representation of underrepresented founders and entrepreneurs in the fund's network.

These key measurements and target values help the fund align its investment strategy with a focus on diversity, equity, and inclusion, driving both financial returns and positive social impact in North America. We will track our investments in alignment with the above criteria as we work towards meeting our $25M goal by 2027.